Features

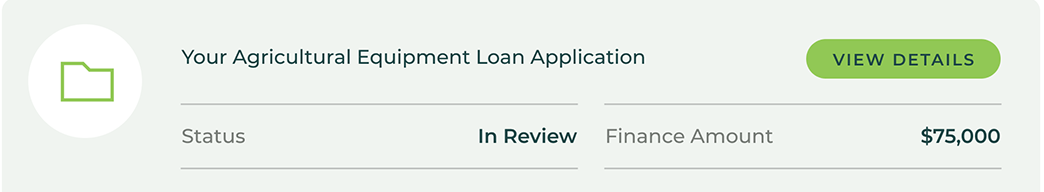

Loan Amount

$10,000–350,000

Loan Terms

36-84 months

Time to Fund

24-48 hours

Find the right financing amount for your business.

Use our calculator tools to model the right loan and payment options for your business.

Products

Flexible financing for your business needs

Being Big on Small™ means we know flexibility is key to making the most of your payments so you can have the financing that make sense for you.

Finance Lease

Finance leases, often referred to as Capital leases, do not fit operating lease guidelines and are an alternative finance vehicle. With a finance lease, the leasing company retains ownership of the equipment and at the end of the lease term, you have the option to purchase the equipment for $1.00 or some other pre-agreed upon fixed price. You cannot expense the monthly payments with a finance lease as you can with an operating lease, but you can take advantage of all of the benefits of ownership including depreciation allowances and Section 179 Tax Deduction.

Equipment Finance Agreements

Equipment Finance Agreements (EFA’s) are straight finance programs where the customer retains title to the equipment and the finance company has a security interest in the equipment. Since you have title to the equipment, there is no purchase option at the end as in a lease product. With EFA’s you can take advantage of all benefits of ownership including depreciation allowances including Section 179. EFA’s are an alternative to bank financing and are preferred over bank financing due to their ease of approval, flexibility in structure, and minimal down payments.

FEATURED

Amur Announcements

Amur Equipment Finance Recognized as a Best Workplace for Innovators by Fast Company

FOR IMMEDIATE RELEASE: Joining Google, Samsung, Mattel, IBM, General Motors, Moderna, and many others GRAND ISLAND, NE – August 5th, 2021 – Amur Equipment Finance, Inc. (“Amur”) is proud to...

Insights from Amur

Vendor Newsletter

Amur Vendor Newsletter, July 2024

Amur is On Target to Exceed $1 Billion in 2024 Originations Amur proudly announces a new volume record for the...

Learn about the program

Amur Announcements

Amur Achieves Record First Half, On Target to Exceed $1 Billion in 2024 Originations

GRAND ISLAND, NE, July 9, 2024 – Amur Equipment Finance, Inc. (“Amur”), a leader in equipment financing, proudly announces a...

Learn about the program

Vendor Newsletter

Amur Vendor Newsletter, May 2024

Amur's Vendor Sales Team Continues to Grow! With business at all time highs, Amur continues to grow its 50+ person...

Learn about the program