Economy Remains Resilient, Despite Banking UncertaintyThe Good NewsDespite higher borrowing costs and tighter access to credit, the US economy has remained resilient! Orders placed with US factories for business equipment rose in May for a second month, indicating companies continue to make longer-term investments despite high borrowing costs and economic uncertainty. The gain in orders was concentrated in a few categories, including machinery, electrical equipment and motor vehicles. Additionally, core capital goods shipments, a figure that is used to help calculate equipment investment in the government’s gross domestic product report, edged up 0.2%. US consumer confidence also increased to the highest level since the start of last year on greater optimism about the labor market and the economic expansion. The Less Good News

|

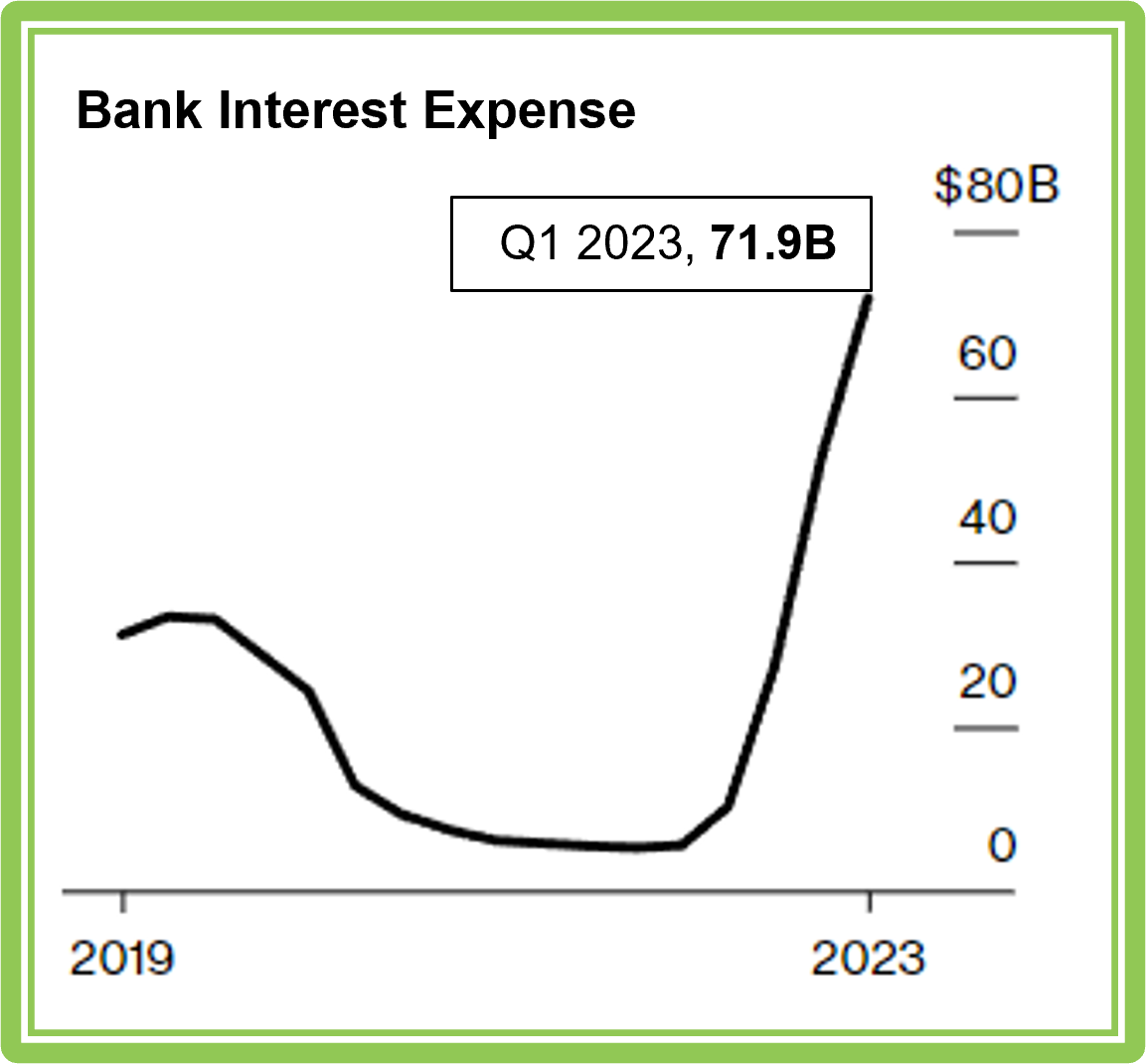

| Furthermore, the increase in the Fed Funds Rate has had a dramatic impact on the cost of deposits at banks as customers’ yield expectations have increased in tandem with prevailing market rates. As a result, the rates that banks are charging for new loans have increased dramatically. (Graphic Source: Bloomberg)

To make matters worse, Fitch Ratings is reporting concern for large and small banks who are significantly exposed to the commercial real estate market. As the default rate of commercial real estate loans rises, this will pressure banks’ liquidity and tighten bank-lending standards . |

The Best News

No matter what the second half of 2023 has in store for us, one this is certain - Amur is ready help finance your sales. We’re one of the largest independent equipment finance companies in the country, and we’re both well-positioned and determined to support your growth.

In fact, we just recently completed our 12th securitization, in which we earned AAA ratings from both S&P and Moody’s and received incredibly strong investor interest from a wide swath of industry participants. This transaction fortifies our capital position, one of the strongest in our industry, and is a testament to the strength of our business model and our team.

We’ve been around for 27 years, so have seen it all. And yet we’re still here and not going anywhere – we’re ready to be your trusted financial partner through the end of 2023 and onwards!

Amur is Your Home for Prime Credit Customers

Request Contact with the Amur Team: One Click to Connect

Amur Plaza Ribbon Cutting

Just outside of our headquarters in the heart of downtown Grand Island NE, the Amur Plaza will be an incredible local hub for entertainment and community. We are thrilled to be a part of this undertaking as this central location has become an important landmark for our city's rich history and its bright future ahead!

The ribbon-cutting ceremony took place on Friday, June 2nd, marking the official inauguration of this special space.

Why Partner with Amur?

Reach out to your Amur sales representative to learn more about how partnering with Amur can unlock your growth:

2. Tech-Powered Decisioning and Servicing Platform which Leads to Easy Transactions

3 Application Integrations that Put You In the Driver’s Seat